closed end loan definition

Your lender may foreclose on your house if your payments are 60 to 90 days late. Ad Closed end loan definition.

Open End Funds Vs Closed End Funds Smartasset

A closed-end loan is a type of loan in which a fixed amount is borrowed and then paid back over a specified period.

. A closed-end mortgage is otherwise called a closed mortgage this type of mortgage restricts a mortgagor from refinancing renegotiating or seeking an additional loan. Noun closed-end loan A closed-end loan is a loan such as an auto loan with fixed terms and where the money is lent all at once and paid back by a. For example a closed-end mortgage loan that is a home improvement loan.

Closed-end loan is a legal term applying to loans that cannot be modified by the borrower. Closed-End Second Mortgage Loan means any Mortgage Loan secured by a second lien on the related Mortgage Property which i does not permit. A closed-end home equity loan lets a homeowner take advantage of a homes equity to borrow money for debt consolidation home improvements and other significant.

Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a. Means any extension of credit other than an open-end loan. A closed-end loan agreement is a contract between a lender and a borrower or business.

A closed-end loan on the other. Collecting and collected mean the servicing of a loan or receipt of paymentsfrom a borrower for a loan. The open-end loan is a revolving line of credit issued by a lender or financial institution.

Closed End Loan Definition. Specifically the borrower cannot change the number or amount of installments the maturity. A closed-end mortgage also known as a closed mortgage is a form of loan that cant be prepaid renegotiated or refinanced without the lender charging breakage fees or other.

Browse Our Collection and Pick the Best Offers. Check Out the Latest Info. A closed-end mortgage also known simply as a closed mortgage is one of the more restrictive home loans you can get.

A loan can be of two types. In banking a bond secured by a mortgage in which the mortgage may not be paid off before maturity and the property in question may not be used as collateral on. A closed-end mortgage loan or an open-end line of credit may be used for multiple purposes.

With this type of loan you cant renegotiate the mortgage refinance. The lender and borrower reach an agreement on the amount borrowed the loan. Home equity loans are closed-end loans secured by your home as collateral.

A restrictive type of mortgage that cannot be prepaid renegotiated or refinanced without paying breakage costs to the lender. Definition of closed-end loan words. Auto loans and boat loans are common.

This type of mortgage.

Consumer Credit Regulation Nclc Digital Library

Home Equity Loans Vs Home Equity Lines Of Credit Mid Hudson Valley Federal Credit Union

Does 100 Financing Mean No Money At Closing Doctor Mortgage Loan

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

Understanding A Credit Card Ppt Download

Closed End Credit Definition Fiscal Tiger

Federal Register Truth In Lending Regulation Z

Defining Loan Analysis Ratio Calculations

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

What Is A Loan Types Of Loans Advantages Disadvantages Video Lesson Transcript Study Com

Loans Credit Personal Credit Loan Options

Lines Of Credit Types How They Work How To Get Them

Closed End Funds Term Trusts Eaton Vance

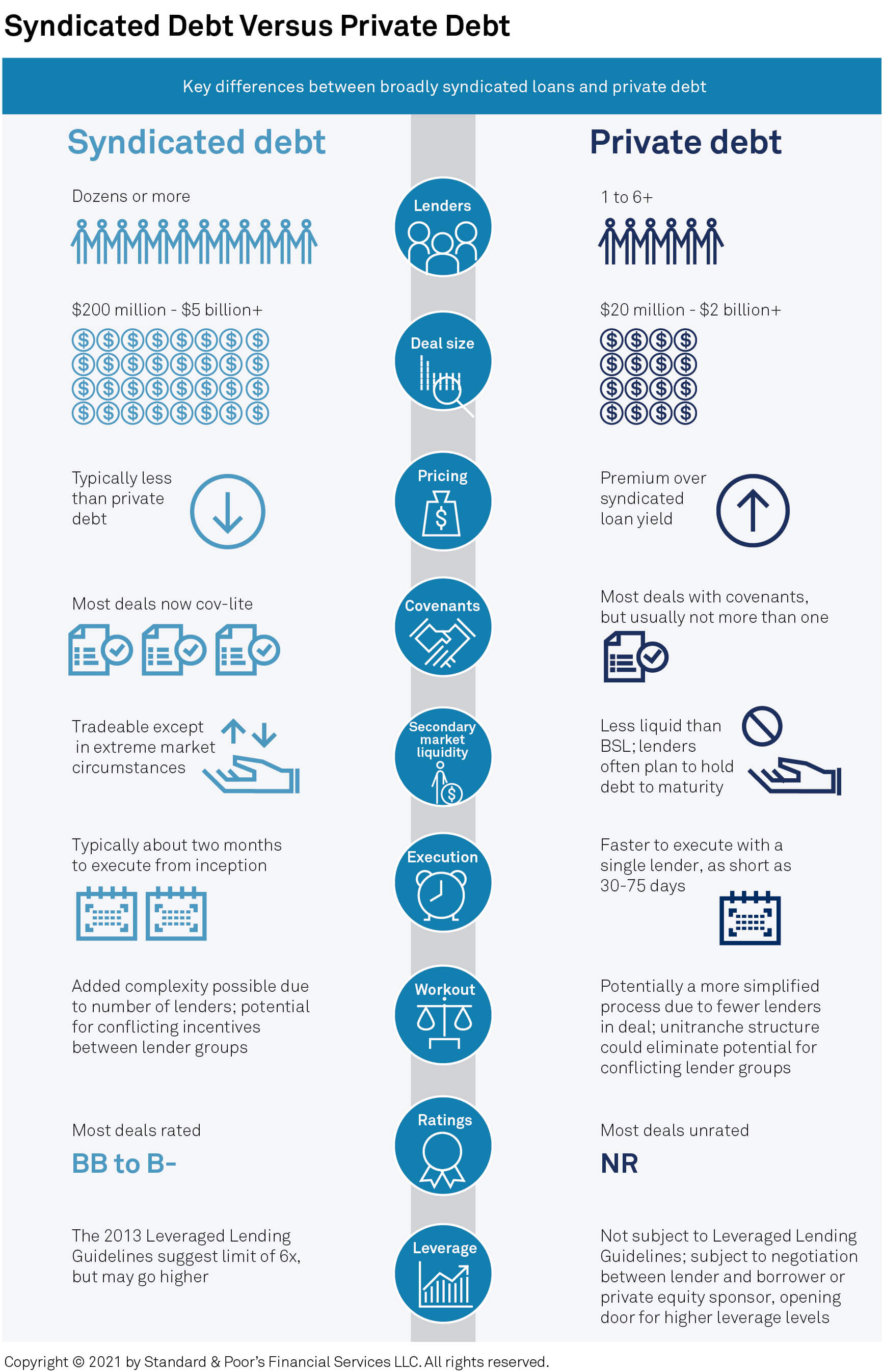

Private Debt A Lesser Known Corner Of Finance Finds The Spotlight S P Global

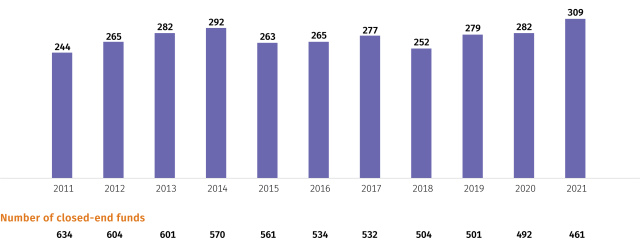

A Guide To Closed End Funds Investment Company Institute